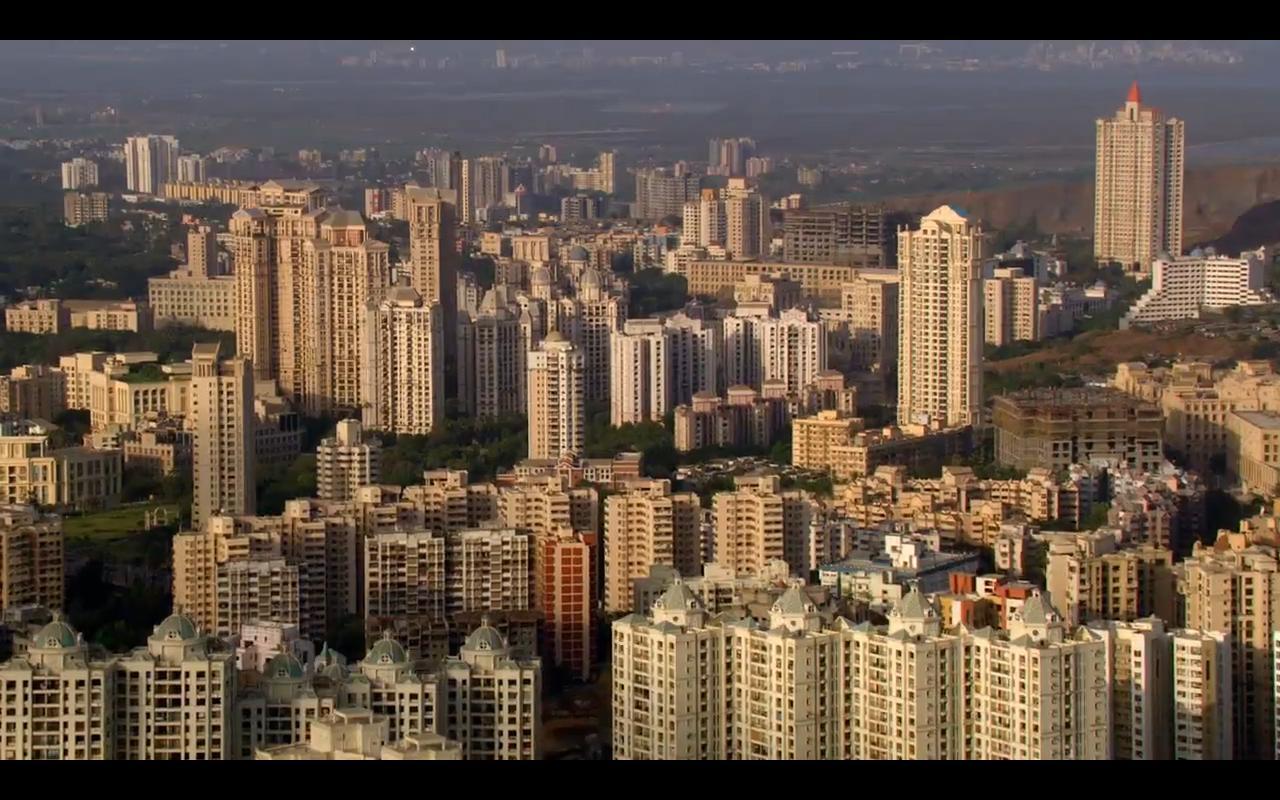

India’s real estate sector—long considered the country’s economic bellwether—is facing a significant slowdown. After years of robust growth, the second quarter of 2025 saw housing sales across the top seven cities slide 20% year-on-year, from approximately 1.2 lakh units in Q2 2024 to about 96,300 units in Q2 2025 (ANAROCK). Is this slump a passing storm, or a signal of a deeper shift in the property market?

National Overview: Sales Plunge, Prices Still Rising

The decline isn’t limited to a few weaker links; it’s a broad-based drop affecting most major metros. However, on a quarter-on-quarter basis, the market did see a small 3% uptick from Q1 2025, offering a hint of stability or early recovery. Notably, average housing prices have continued to edge up by about 11% year-on-year, making homes even less affordable for the middle class.

MMR and Pune: Steepest Declines

The Mumbai Metropolitan Region (MMR) and Pune were hit hardest, with MMR sales plunging 25% y-o-y and Pune by 27%—together accounting for nearly half of India’s Q2 housing sales drop. Meanwhile, metros like Hyderabad and Delhi-NCR each saw declines of 27% and 14%, respectively. Only Chennai bucked the trend, with an 11% increase in annual housing sales—driven by resilient demand and a 40% quarter-on-quarter jump.

What’s Behind the Dip? Prices, Rates, and Global Instability

Several forces combined to push buyers to the sidelines:

-

Rising home prices: The national average has climbed to nearly ₹9,000 per sq. ft., with double-digit increases in key cities like NCR and Bangalore.

-

Geopolitical tensions: Ongoing conflicts abroad (especially in the Middle East) and recent military action at home have left consumers skittish.

-

Interest rate squeeze: While the Reserve Bank of India finally cut the repo rate by 100 basis points during Q2, the relief was too late to rejuvenate flagging buyer sentiment during the quarter.

-

High-end homes dominate sales: A larger share of new supply and sales was in the premium and luxury category, pushing middle-income and first-time buyers out.

Fewer New Launches, Focus on High-Value Projects

Developers responded to cooling demand by reining in new projects. New launches fell 16% year-on-year—from approximately 1.17 lakh to 98,600 units—with MMR and Delhi-NCR accounting for nearly half of all fresh supply. Despite the pullback, the value of total sales still inched up by 1%, thanks to the shift toward higher-ticket, luxury homes.

Is This a Tipping Point or a Passing Phase?

Despite steep declines, some experts see reasons for optimism:

-

Ongoing jobs growth and a young demographic mean India’s long-term housing demand remains sound.

-

The Q2 slowdown was exacerbated by external shocks; with domestic tensions easing and interest rates cut, early signs of a rebound are emerging, such as the sequential (quarter-on-quarter) uptick in both sales and launches.

Advice for Buyers and Sellers

For buyers:

Softer sales and more realistic sellers create opportunities to negotiate—especially as developers may offer incentives or price corrections in weaker segments.

For sellers:

Pricing to the market and flexibility are key. Overpricing risks longer inventory time, given the cautious buyer environment.

For both:

Monitor central bank actions, as further rate cuts may help affordability and spur demand in the coming quarters.